The Best Strategy To Use For Top-rated Bankruptcy Attorney Tulsa Ok

Table of ContentsTulsa Bankruptcy Lawyer for DummiesThings about Tulsa Debt Relief AttorneyThe Definitive Guide to Experienced Bankruptcy Lawyer TulsaAn Unbiased View of Experienced Bankruptcy Lawyer TulsaThe 6-Minute Rule for Tulsa Bankruptcy Filing Assistance

The stats for the other main kind, Chapter 13, are also worse for pro se filers. Suffice it to say, talk with an attorney or 2 near you who's experienced with insolvency legislation.Several attorneys also supply totally free examinations or email Q&A s. Take advantage of that. (The non-profit application Upsolve can help you discover free consultations, resources and legal help for free.) Inquire if bankruptcy is without a doubt the ideal choice for your circumstance and whether they believe you'll qualify. Prior to you pay to file bankruptcy kinds and acne your credit record for approximately ten years, check to see if you have any feasible choices like debt arrangement or charitable credit score therapy.

Ad Currently that you've chosen bankruptcy is undoubtedly the best course of activity and you hopefully cleared it with an attorney you'll require to obtain begun on the documents. Prior to you dive right into all the official bankruptcy types, you need to get your own documents in order.

Some Known Incorrect Statements About Experienced Bankruptcy Lawyer Tulsa

Later down the line, you'll actually require to verify that by revealing all kind of info regarding your monetary affairs. Right here's a basic listing of what you'll need when driving ahead: Identifying records like your chauffeur's license and Social Safety and security card Income tax return (as much as the previous four years) Proof of revenue (pay stubs, W-2s, self-employed earnings, earnings from possessions in addition to any income from federal government advantages) Bank statements and/or pension declarations Evidence of value of your properties, such as lorry and realty assessment.

You'll desire to recognize what sort of financial obligation you're attempting to deal with. Financial debts like kid support, alimony and particular tax obligation financial obligations can not be released (and personal bankruptcy can't halt wage garnishment associated to those debts). Pupil financing financial obligation, on the other hand, is not difficult to discharge, yet note that it is difficult to do so (bankruptcy attorney Tulsa).

You'll desire to recognize what sort of financial obligation you're attempting to deal with. Financial debts like kid support, alimony and particular tax obligation financial obligations can not be released (and personal bankruptcy can't halt wage garnishment associated to those debts). Pupil financing financial obligation, on the other hand, is not difficult to discharge, yet note that it is difficult to do so (bankruptcy attorney Tulsa).If your earnings is too expensive, you have another alternative: Chapter 13. This alternative takes longer to settle your debts since it calls for a long-term payment strategy typically three to 5 years before some of your staying financial obligations are cleaned away. The declaring procedure is likewise a lot more complicated than Chapter 7.

Top Tulsa Bankruptcy Lawyers for Beginners

A Chapter 7 personal bankruptcy stays on your debt record for one decade, whereas a Phase 13 bankruptcy diminishes after seven. Both have enduring impacts on your credit rating, and any kind of new debt you take out will likely come with higher passion rates. Prior to you submit your personal bankruptcy types, you must initially complete a required program from a credit report counseling agency that has actually been accepted by the Department of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The course can be completed online, face to face or over the phone. Programs usually cost in between $15 and $50. You need to complete the course within 180 days of filing for personal bankruptcy (Tulsa OK bankruptcy attorney). Utilize the Department of Justice's site to locate a program. If you stay in Alabama or North Carolina, you have to choose and complete a course from a listing of independently approved service providers in your state.

Getting My Affordable Bankruptcy Lawyer Tulsa To Work

A lawyer will normally handle this for you. If you're filing on your own, know that there have to do with 90 various insolvency areas. Inspect that you're submitting with the appropriate one based on where you live. If your permanent home has actually relocated within 180 days of loading, you must file in the area where you lived the greater part of that 180-day period.

Usually, your bankruptcy lawyer will deal with the trustee, but you may require to send the person files such as additional reading pay stubs, income tax return, and savings account and charge card declarations directly. The trustee who was just assigned to your case will certainly quickly set up a compulsory meeting with you, known as the "341 conference" due to the fact that it's a need additional info of Section 341 of the U.S

You will require to offer a timely list of what certifies as an exception. Exceptions may put on non-luxury, key automobiles; essential home items; and home equity (though these exceptions policies can differ extensively by state). Any type of property outside the list of exemptions is thought about nonexempt, and if you don't offer any type of listing, then all your building is considered nonexempt, i.e.

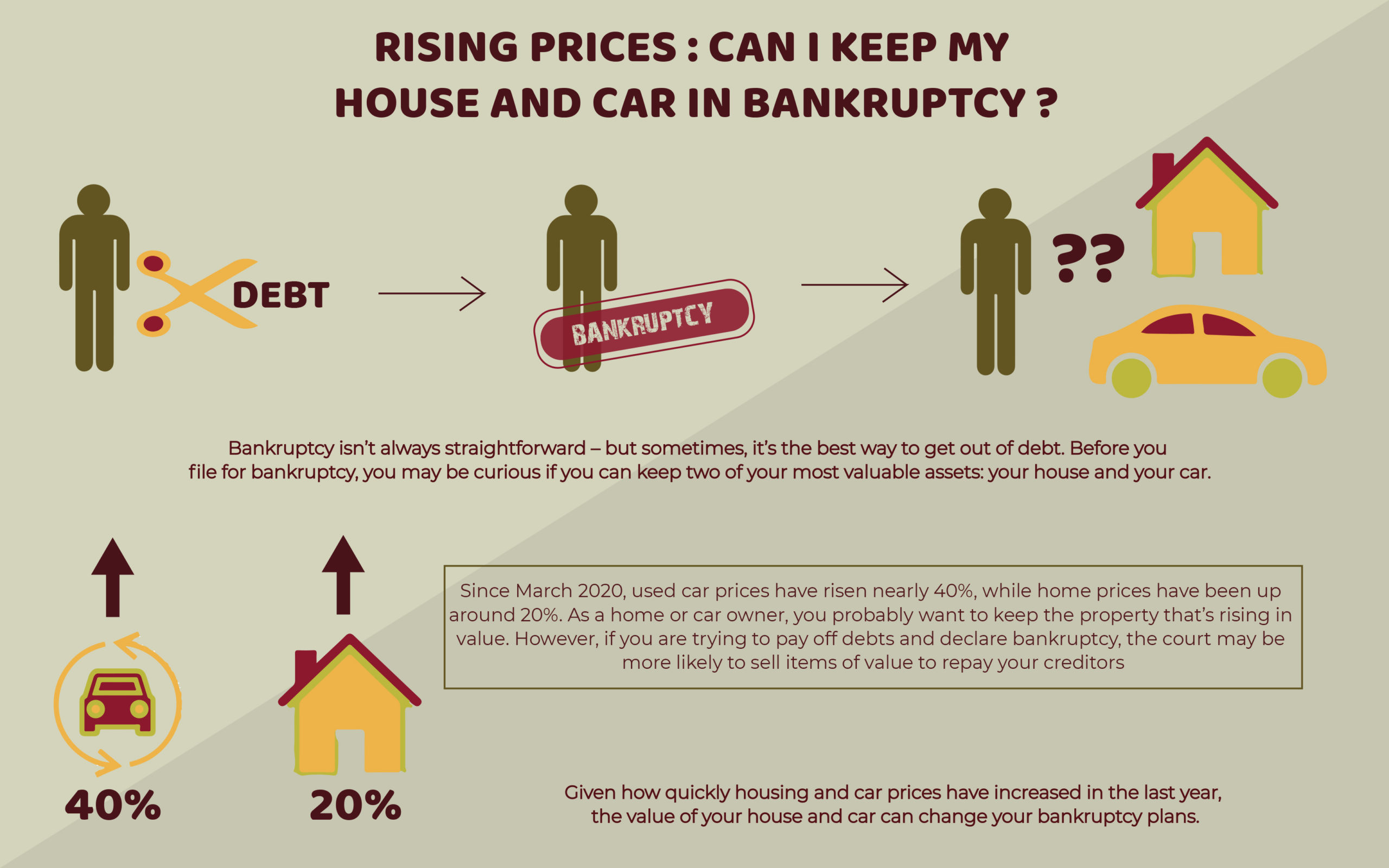

You will require to offer a timely list of what certifies as an exception. Exceptions may put on non-luxury, key automobiles; essential home items; and home equity (though these exceptions policies can differ extensively by state). Any type of property outside the list of exemptions is thought about nonexempt, and if you don't offer any type of listing, then all your building is considered nonexempt, i.e.The trustee wouldn't market your sports vehicle to quickly settle the lender. Rather, you would certainly pay your lenders that quantity over the course of your layaway plan. An usual false impression with personal bankruptcy is that when you file, you can quit paying your financial obligations. While bankruptcy can help you eliminate much of your unsecured financial obligations, such as overdue clinical expenses or individual financings, you'll desire to keep paying your monthly settlements for safe financial debts if you intend to maintain the residential property.

Best Bankruptcy Attorney Tulsa Things To Know Before You Get This

If you go to danger of repossession and have actually exhausted all various other financial-relief choices, then submitting for Phase 13 may delay the repossession and conserve your home. Inevitably, you will certainly still need the earnings to proceed making future home loan payments, in addition to paying off any late payments throughout your payment strategy.

The audit could delay any type of financial obligation relief by a number of weeks. That you made it this far in the process is a decent indication at the very least some of your debts are eligible for discharge.